News: Rent-yielding assets may no longer be the cash cow for realty companies-22-04-2020

Updated on : 22-04-2020

“As the reduction in demand for incremental office space is expected to coincide with increase in commercial office space supply, we expect a likely impact to rentals,” Goldman Sachs said in a report.

ET Intelligence Group: WFH has dimmed the allure of glitzy, glam and global-scale offices, which had sought to recreate a piece of the famed Harborside in Hyderabad. So, those futuristic glass-and-steel structures might not yield as much money after all for Indian property companies as they promised earlier.

Already, Tata Consultancy Services (TCS), India’s biggest software company, has said that it will be promoting the remote working model; the outsourcing industry makes up over 50% of the occupancy in India’s commercial property industry and many might follow the leader TCS.

“As the reduction in demand for incremental office space is expected to coincide with increase in commercial office space supply, we expect a likely impact to rentals,” Goldman Sachs said in a report. “Most properties have a mark-to-market releasing potential... ranging from -2% to 50.”

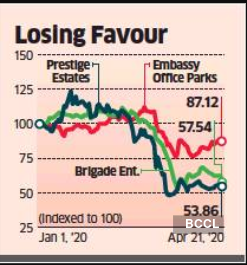

Other realty consultants like JLL and Anarock, too expect accelerated adoption of WFH by Indian firms. This may not be positive for the south-based developers, including Embassy, Prestige Estates, Sobha and Brigade Enterprises, which rely on commercial assets for their stock valuation. In addition, most of them have significant debt and inventories, and lack of meaningful cash flows will mean challenging times.

Embassy is the only company with a REIT and its shares are down 30% from 2020 highs. Its 80% leasable space is leased to MNCs. Analysts have deferred the cash flows from leasing of upcoming areas and cut estimates.

Prestige has debt of Rs 7,600 crore and inventories of over Rs 3,000 crore. After the lockdown, earlier projections of rental income at Rs 1,000 crore in FY20 and Rs 1,400 crore in FY21may not be as rosy. Its debt to EBIDTA is almost 6 times — in the red zone — with the commercial segment making up 60% of the stock value.

Sobha’s debt to EBIDTA is above 4 times. Although commercial assets are less, some analysts are assigning a value of Rs 44 per share (CMP is Rs 213).

For Brigade Enterprises, analysts assign two-thirds of the total gross asset value and more than 90% of the value per share to the rental business. Its estimated net debt in FY20 is about 4 times operating profit.